- Latest: Welcome to Auto Futures - Mobility News, Features, Exclusives and More...

- Latest: Honda to Invest $11 Billion in EV Supply System & Capability in Canada

- Latest: CATL Unveils Shenxing PLUS, Enabling 1,000-km Range and Superfast Charging

- Latest: Mercedes-Benz Announces In-car Gaming Cooperation With Tencent & Electronic Arts

- Latest: LG Chem & Factorial Announce Plans to Develop Solid-State Batteries

- Latest: The Rise of the Humanoid Robots (and how OEMS can Benefit) - Apptronik's CCO

How Singapore's Zensung is Saving Lives and Money Whilst Incentivising Drivers - CEO Amod Dixit

Rahul Dutta Roy

- Nov 28 2022

Singapore-based Zensung has been making the right noise with its all-new application PARROT. The AI-enabled platform for driver analytics is the brainchild of Founder and CEO, Amod Dixit.

Auto Futures recently caught up with this former Managing Director of one of the world’s largest commercial banks to get the story straight from him.

“When speaking to CEOs and CFOs of insurance companies, it became very clear that their loss to premium ratios across ASEAN countries is 70% to 80%. In fact, in some cases, it is even more than 100%, so you can clearly see that they don't make much money. On digging deeper into the problem, a few clear examples emerged, and from the looks of it, they could all be solved if these companies were able to consume data differently,” says Dixit.

Dixit's solution of how data could be consumed differently was just the tip of the iceberg. What most of these executives knew was the fact that for insurance companies, getting quality data is always a challenge. The reason for this is that the data models of most of these companies are all based on historical data, design and development included.

Dixit knew that he had found an answer to a complex problem. Armed with the confirmation from his target group, he set out to create Zensung.

“Our first area of focus was general insurance, specifically motor or auto insurance, which is responsible for about 60% of the premiums that most insurance companies generate. We knew we had to start by collecting data, and to that end, we started to create our driving application without directly entering into the insurance side of things," he explains.

When it comes to data, most insurance companies face significant challenges. To start with, these companies have never really invested much into technology, with most of their systems having been designed and developed a good 10-15 years back. Given their legacy systems, developing automation in insurance companies for the simplest use cases can be an extremely complex task.

Giving some real-world examples, Dixit explains the complexities. “Let's say that the insurer is working with several brokers or car dealers. In their system, they need to create a different policy for each broker and car dealer. Their technology does not support one policy which can be used with some customisation for different people. This is just one part of it."

“Second, there is a massive dependency on the middle-man - agents, brokers - to sell insurance to end users and service them to some extent, which means that there is no loyalty between the policy-holders and the insurance companies. Tomorrow, if another insurer gives me $10 less than what I'm paying today, I will tend to move to that new insurer."

"The third challenge is from the policyholder's point of view. Everyone tends to have the same policy and the same premium. There is no differentiation between the good drivers and the not-so good ones. We don't want to penalise bad drivers, but we need to incentivise good driving to promote overall safety,” he adds.

Rewarding Good Driving With Incentives

Zensung’s PARROT is the culmination of all these problem statements and more. This app gives end-users a complete break-down of their driving behaviour. Recent data from the World Health Organisation show that car accidents result in the death of around 1.3 million people each year. On digging deeper, it found that around 85% of the accidents happen because of distractions while driving.

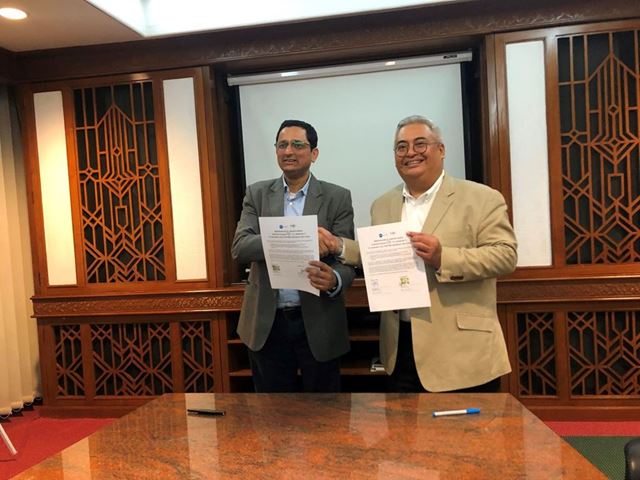

According to Dixit, through PARROT, Zensung has leveraged data analysis to identify these distractions and helped users with driving by recommending areas of improvement. Such was the power of the use-case of this technology that Zensung was approached by Indonesia’s largest insurer, TUGU Insurance, to create a white-label application for them. This led to the launch of T-Drive, an app that is being used by motorists across Indonesia today.

“Our technology gives drivers a complete picture of just how they have driven. Users can clearly see whether or not at any point during a trip there have been instances of cornering, lane-change, harsh braking, harsh acceleration, over-speeding and more. This data remains on an individual’s phone and is not visible to others, ensuring complete privacy and safety. Other data points visible to them include day driving vs. night driving, the carbon emissions for a trip, over-speeding vs. speed limit at a location, and phone calls made or received during a ride. Now, based on 50+ parameters, each trip gets a trip score. This visualisation of data and this gamification of the driving experience has been very powerful in prompting users to correct their driving behaviour."

Zensung is also supplementing this with incentivisation of good driving behaviour and frequent safety campaigns.

“We ran a safety campaign with a large Indian conglomerate, where they used this app to promote driving safety among their employees and associates. After three weeks, the top scorers received incentives, while the bottom 20% needed to have a sit-down with the company’s HR to understand why safe driving is important for them and their families."

Similarly, in Indonesia, top drivers received bonus points and coins, which could then be used to redeem incentives from TUGU’s partner ecosystem.

In Indonesia, Zensung went beyond driving analytics into claims management, where users were able to click a picture or a video after an accident to capture a proof of damage, submit this to the insurance company’s app, select a workshop in Jakarta, book an appointment at the workshop and track the claims process right until you can check-out the vehicle from the workshop.

All of this is entirely digital, giving users complete visibility of the entire process and saving them hours of coordination and follow-ups on phone, or visits to insurance officers and agents for filing claims.

Computing Carbon Emissions

On the SaaS side, Zensung has also built a robust platform for insurers, where they can clearly manage multiple aspects of insurance business like payment gateways, agent commissions, product management, redemption partners, etc. On this platforms, insurers can also see every claim request, related information, proof in the form of photo or video, an AI-generated reliability score of the proof submitted to tackle the nuisance of fake accident claims, and the ability for insurers to pass claims digitally without having to rely on surveyors and other middlemen.

As Dixit explains: “This, essentially, plugs the gap in the system where people make claims for fake accidents, or get their cars repaired for issues other than the damage caused by the accident. It also tackles the issue of surveyors charging insurers for multiple unnecessary visits for the same case file. Cumulatively, it translates into a lot of money. Our platform makes certain that insurers aren’t bleeding money.”

But that’s not all that Zensung has accomplished. “We have launched Asia's first GoGreen insurance in Singapore called Parrot Safe Driving (Driver) Policy in Singapore, which has been underwritten by German insurer ERGO. We compute carbon emission for every trip of the policyholder and show them their carbon footprint. Carbon emissions are computed using GreenHouse Gas Protocols (GHG Protocols)."

"At the end of every quarter, we allow them to redeem their reward points, where they can either get Shell vouchers or buy a Green certificate or carbon credits from a United Nations gold standard organisation. Recently, we have issued 2+ tonnes worth of Green certificates to a few policyholders,” adds Dixit.

Zensung is very clear about how it wants to add value. To start with, the company wants to promote safety and sustainability within drivers. For individual policyholders, it wants to save lives, money and the environment. For insurance companies, it wants to further digitisation in the space and help them save money.

But that apart, it is also contributing to the larger ecosystem by collaborating with relevant government authorities to help provide data, which is of course anonymous to protect the privacy of end-users, in order to further the cause of road safety.

According to Dixit, while the company is growing from strength-to-strength in Singapore and Indonesia, Philippines seems to be the next destination, after which expanding to India might be on the cards.

Tags

Popular Categories